This is the question a lot of people are asking as thousands of Californians continue to reel from the devastating wildfires this year and last.

While the investigation is still ongoing into the causes of the Camp Fire, at least one utility company has been feeling the repercussions for 17 of 21 major wildfires in late 2017. As stock values plummet, some of this expense could be passed on to utility customers, but ultimate liability for California’s recent fires remains up in the air.

Wildfires and Utility Companies

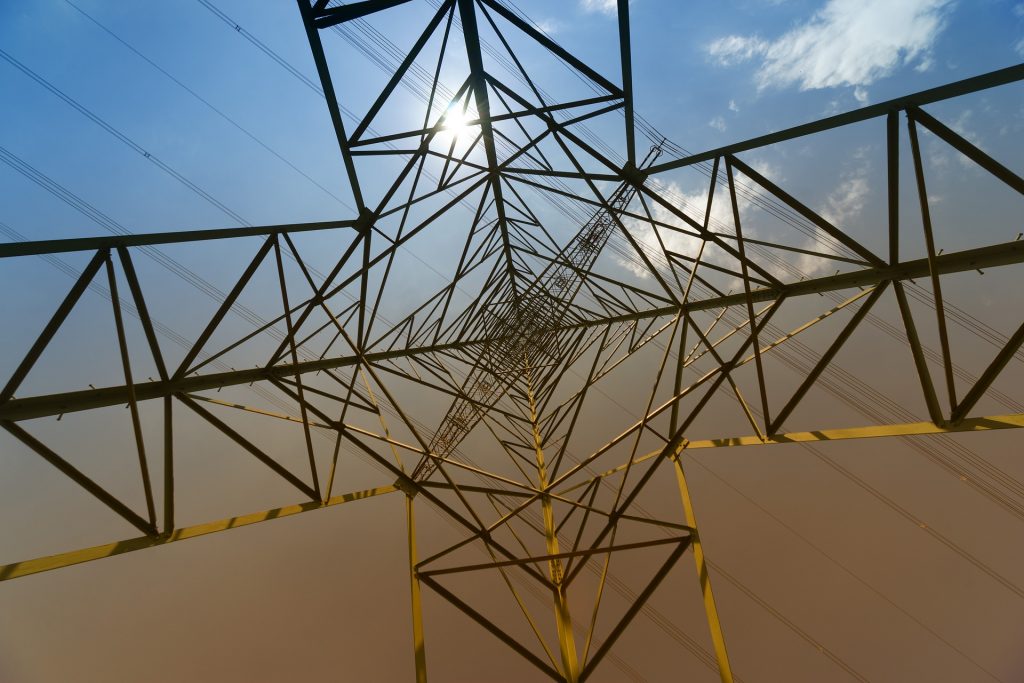

As we process the devastation of the tragic Camp Fire, it’s only natural to look for answers as to how something so terrible could have happened. Early reports have pointed toward Pacific Gas and Electric Company (PG&E) as a possible candidate for blame. State officials have already determined that failures in equipment owned by PG&E, like power lines, were responsible for 17 of 21 major fires in Northern California last year. This has created a situation in which PG&E could be liable for more than $15 billion in damages due to the destruction those fires caused.

Civil lawsuits revolve around negligence and liability. Negligence means a company or its employees acted in a way that was contrary to how a reasonable person would have acted in a similar situation. Liability means that the act of negligence directly caused or contributed to people’s injuries and property losses.

In this case, the question is, “Did having poorly maintained and overworked power lines and poles constitute an act of negligence on the part of PG&E?” If a California jury decides the answer is “Yes,” PG&E would be liable for fire damage caused by failures in those lines.

The Ultimate Cost

Right now, PG&E’s exposure to $15 billion in liability for 2017’s fires is only an estimate—it could go up. As details continue to come in about the Camp Fire, experts estimate the number could double when all is said and done. But a recently passed California Senate Bill allows PG&E to potentially sell bonds to help pay for this liability, which far exceeds their insurance coverage. These bonds would be repaid over time by increasing rates to customers, essentially passing liability for these fires on to their customers.

Call a Tough Personal Injury Lawyer

If you have lost a loved one or a home in a wildfire, you have avenues for compensation, but you must act quickly. Call our Southern California natural disaster attorneys at NordstrandBlack PC at (805) 962-2022. Tell us what happened, and we can discuss your legal options. We have helped mudslide victims in the area, and we want to help you, too.